All Categories

Featured

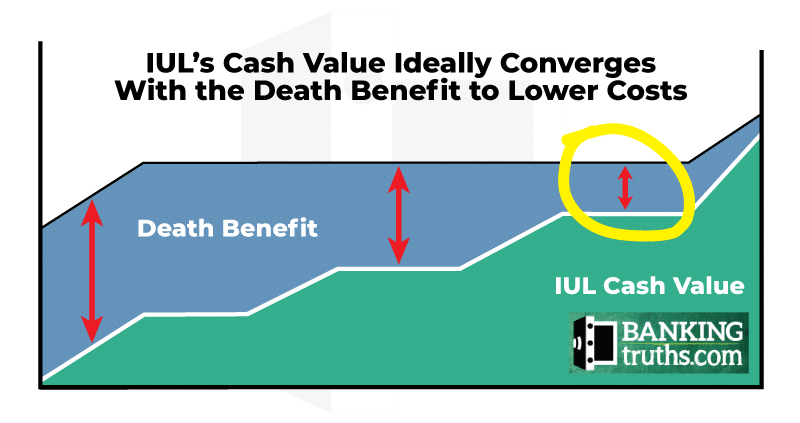

However, these policies can be much more intricate contrasted to other kinds of life insurance policy, and they aren't always best for each investor. Speaking to an experienced life insurance policy representative or broker can aid you determine if indexed universal life insurance policy is a good fit for you. Investopedia does not offer tax, financial investment, or economic services and suggestions.

A 401(k) is a much better retired life investment than an LIRP for most individuals as a result of the LIRP's high premiums and a reduced return on investment. You shouldn't add life insurance policy - iul università telematica degli studi to your retired life planning till you optimize prospective cost savings in a 401(k) plan or IRA. For some high-net-worth people, including an irreversible life policy to their investment portfolio might make good sense.

Reduced prices of return: Current study discovered that over a nine-year duration, worker 401(k)s expanded by a standard of 15.6% annually. Compare that to a fixed rates of interest of 2%-3% on a long-term life plan. These differences build up with time. Applied to $50,000 in cost savings, the charges over would certainly equal $285 each year in a 401(k) vs.

In the exact same vein, you can see investment development of $7,950 a year at 15.6% rate of interest with a 401(k) contrasted to $1,500 annually at 3% interest, and you 'd spend $855 even more on life insurance policy every month to have entire life protection. For many people, obtaining irreversible life insurance policy as part of a retired life plan is not an excellent idea.

Www Iul Edu Lb

Below are 2 common kinds of long-term life policies that can be utilized as an LIRP. Entire life insurance policy offers fixed premiums and cash worth that grows at a fixed price established by the insurance provider. Typical financial investment accounts normally use higher returns and even more versatility than whole life insurance policy, however entire life can offer a fairly low-risk supplement to these retired life savings techniques, as long as you're confident you can afford the premiums for the life time of the policy or in this instance, till retirement.

Latest Posts

Iul Benefits

Universal Life Death Benefit Options

Universal Life Insurance Canada