All Categories

Featured

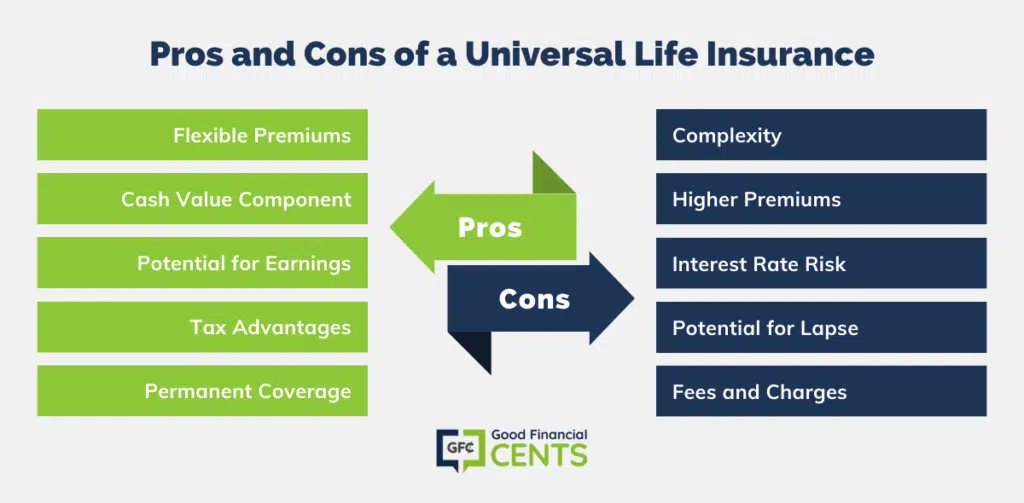

Nevertheless, these policies can be a lot more complicated contrasted to various other kinds of life insurance, and they aren't necessarily best for every single financier. Speaking with a knowledgeable life insurance policy agent or broker can assist you determine if indexed universal life insurance policy is an excellent fit for you. Investopedia does not give tax obligation, financial investment, or financial solutions and advice.

, including an irreversible life plan to their investment profile may make sense.

Low rates of return: Current research found that over a nine-year period, worker 401(k)s expanded by an average of 15.6% annually. Contrast that to a set rate of interest rate of 2%-3% on a long-term life plan. These distinctions add up with time. Applied to $50,000 in financial savings, the fees over would certainly equate to $285 per year in a 401(k) vs.

In the exact same blood vessel, you could see financial investment development of $7,950 a year at 15.6% rate of interest with a 401(k) compared to $1,500 each year at 3% rate of interest, and you 'd spend $855 even more on life insurance policy every month to have whole life protection. For the majority of people, obtaining long-term life insurance as component of a retired life plan is not a great idea.

Iul Vs 401(k): Which Is Better For Retirement Savings?

Conventional investment accounts usually offer higher returns and more flexibility than whole life insurance policy, but whole life can provide a relatively low-risk supplement to these retirement financial savings techniques, as long as you're confident you can pay for the premiums for the life time of the plan or in this instance, till retired life.

Latest Posts

Iul Benefits

Universal Life Death Benefit Options

Universal Life Insurance Canada